Tax asset depreciation calculator

Our Resources Can Help You Decide Between Taxable Vs. Likewise the business will calculate the depreciation charge for all qualified tangible assets.

Depreciation Formula Calculate Depreciation Expense

Press CTRLN to create a new calculation date for the tax depreciation.

. All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting. The rate of depreciation is 50 and the salvage. Gas repairs oil insurance registration and of course.

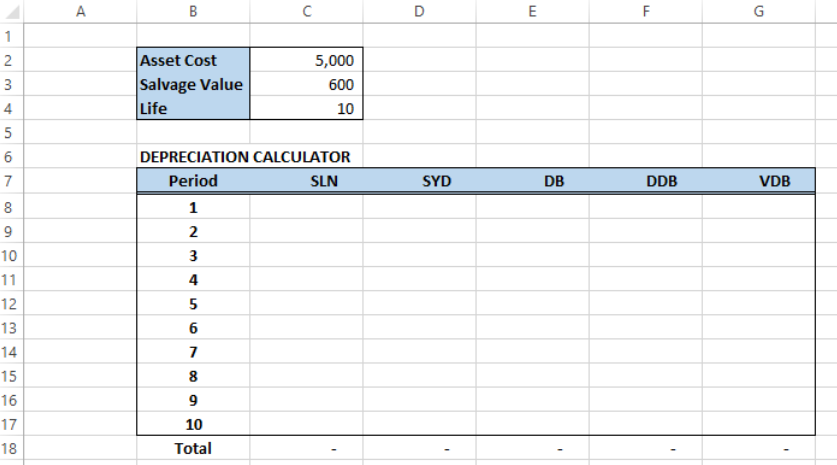

The depreciation calculator above is provided as a general guide to allow you to estimate the potential depreciation you may be entitled to claim on a property. The cost of the fixed asset is 5000. Deferred tax asset is an accounting term that refers to a situation where a business has overpaid taxes or taxes paid in advance on its balance sheet.

How are assets depreciated for tax purposes. Block of assets Rate of depreciation 5. Compare price features and reviews of the software side-by-side to make the best choice for your.

Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States.

Double Declining Balance Method. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the. Ad Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

Asset Depreciation Calculator See. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. For example suppose company B buys a fixed asset that has a useful life of three years.

If you have any questions about how they work or even have. Straight Line Asset Depreciation Calculator Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. The tool includes updates to reflect tax depreciation.

Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules. These taxes are eventually.

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. There are several types of depreciation methods companies can use to write off the assets. Fixed Asset Pro using this comparison chart.

In the Period name field enter a name for the tax. Tax depreciation expense can be calculated by using approved methods only. Looking at the depreciation table in Publication 946 the rate shows as 1819 for an asset placed into service in the 4th month which would give you 2547 in depreciation.

The Income Tax Act 1961. Addition for a period of 180 days or more in the previous. Compare Depreciation Calculator vs.

Ad Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Depreciation rate as per the Companies Act 10 Depreciation rate as per the Income Tax Act 15 For the financial year 2020-21 the company also generated a revenue.

Written down value on the first day of previous year. The calculator will display how the asset will depreciate over time the depreciable asset value the yearly depreciation rate and the annual depreciation. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle.

Depreciation asset cost salvage value useful life of asset 2. The Depreciation Calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. However the Calculator is.

Click Fixed assets Periodic Tax depreciation. The MACRS Depreciation Calculator uses the following basic formula.

Depreciation Schedule Template For Straight Line And Declining Balance

Straight Line Depreciation Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Depreciation What Is The Depreciation Expense

Asset Depreciation Schedule Calculator Template

Depreciation What Is The Depreciation Expense

Depreciation Tax Shield Formula And Calculator

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation In Excel Excelchat Excelchat

Depreciation Formula Calculate Depreciation Expense

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Depreciation Macrs Youtube

Free Macrs Depreciation Calculator For Excel

Depreciation What Is The Depreciation Expense

1 Free Straight Line Depreciation Calculator Embroker

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation